The End of Black-Box AI: Why ESG and Carbon Data Are Forcing Full Transparency in Artificial Intelligence

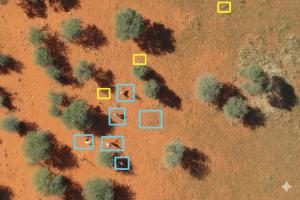

Drone used for data collection

15% of global climate finance reaches the Global South. New regulations are forcing AI toward auditable, data-centric systems to scale climate investment

LONDON, LONDON, UNITED KINGDOM, December 17, 2025 /EINPresswire.com/ -- More than USD 1.3 trillion in climate and environmental finance is expected to flow globally each year by the end of this decade, yet less than 15% currently reaches the Global South, where emissions growth, urban expansion, and climate vulnerability are most acute. The bottleneck is not capital availability, but data. Investors, governments, and multilateral institutions are sitting on unprecedented pools of finance, while struggling to access climate data that is reliable, comparable, auditable, and usable at scale. This gap is where artificial intelligence and structured data are beginning to work together—not as innovation theatre, but as economic infrastructure.

For years, AI has been praised for its ability to process complexity at speed, but in sustainability and ESG it has often amplified an existing problem: opacity. Models generated insights without showing their workings. Dashboards summarized outcomes without traceability. Decisions were made on outputs that could not be reproduced, audited, or legally defended. As long as sustainability reporting was largely voluntary, this lack of transparency was tolerated as the cost of innovation. That tolerance is disappearing fast.

Across carbon markets, climate disclosures, and ESG regulation, AI outputs are no longer suggestions. They are becoming evidence—used to set national baselines, price carbon, determine cross-border taxes, unlock concessional finance, and allocate capital across infrastructure and industry. In this environment, black-box AI is not merely insufficient; it is a material risk. When a single data point can influence sovereign reporting, infrastructure investment decisions, or trade exposure, the central question shifts from how intelligent a system is to whether it can be trusted.

What is driving this shift is not an abstract ethics debate, but regulation and economics. Climate data is hardening into law. Carbon border adjustment mechanisms, Paris Agreement reporting requirements, national greenhouse gas inventories, and green finance taxonomies are turning emissions and performance data into regulated economic assets. AI systems operating in this space are being forced to evolve accordingly. The most valuable systems today are not those that generate the greatest volume of outputs, but those that can clearly demonstrate where data originated, how it was processed, what assumptions were applied, and how results can be independently verified—consistently, repeatedly, and at scale.

This transition is particularly transformative for the Global South. Many countries do not lack climate projects, ambition, or political intent. What they lack is the data infrastructure required to translate activity on the ground into outcomes that global capital can recognize, price, and trust. When AI is paired with structured, verifiable data capture—rather than layered on top of fragmented spreadsheets and disconnected reporting processes—it becomes possible to shorten verification cycles from years to months, dramatically reduce transaction costs, and make projects legible to international investors and multilateral institutions.

In this context, artificial intelligence stops being a reporting aid and becomes a market enabler. Environmental finance does not scale on promises, narratives, or intent. It scales on data that survives scrutiny, audit, and legal challenge. AI systems designed around transparency and governance make it possible to reuse the same trusted data across reporting, finance, markets, and policy, unlocking efficiencies that were previously unattainable.

The result is a quiet but profound shift in how AI is being designed and deployed. Models are moving closer to the data, not the other way around. Transparency is being engineered into systems from the outset. Governance, version control, and auditability are becoming core features rather than afterthoughts added late in the process. This is not a retreat from innovation, but a maturation of it—a recognition that intelligence without accountability cannot operate at scale in regulated environments.

Black-box AI is not disappearing because it failed technologically. It is disappearing because the world it helped shape now demands more of it. As sustainability, infrastructure, and finance converge, artificial intelligence is being reshaped into something more durable and consequential: a system that does not just predict outcomes, but can stand behind them when it matters most.

About Green Economy Partnership

Green Economy Partnership (GEP) is a climate-tech and decarbonization infrastructure organization focused on enabling governments and corporates to implement the Paris Agreement at scale. GEP develops data-centric platforms combining AI, blockchain and economic modelling to support carbon markets, national registries and climate finance, with a strong focus on the Global South.

yallah@greeneconomy.ae +971504400162

About Ivano Iannelli

Ivano Iannelli is a sustainability, AI and carbon markets subject matter expert with over 25 years of experience working across governments, multilateral institutions and heavy industry. He has held senior leadership roles with the United Nations, Dubai Carbon and major industrial groups, and currently focuses on designing transparent, auditable AI systems for regulated climate and ESG data.

ivanoi@greeneconomy.ae +971505587503

Pull Quotes

“Black-box AI didn’t fail—it is adapting to became compatible with regulation.”

“In climate and ESG, AI outputs are no longer insights; they are evidence.”

“Capital doesn’t scale on ambition. It scales on data that survives scrutiny.”

“The future of AI belongs to systems that can stand behind their results.”

Ivano Iannelli

Green Economy Partnership

+971 50 558 7503

yallah@greeneconomy.ae

Visit us on social media:

LinkedIn

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.